How to set up an Employee Ownership Trust

Selling your business to an Employee Ownership Trust (EOT) is a big milestone for owner-managed businesses.

Trust, Transfer, and Repayment

Three Key Stages to Set Up

This process involves three main stages, starting with the creation of the EOT through a detailed trust deed. During this phase, choosing the right trustees is crucial, requiring careful consideration in advance.

The second stage involves the actual purchase, where the EOT acquires a controlling stake (more than 50% of shares) from the existing shareholder. Any extra cash on the company’s balance sheet can be given to the EOT during completion and used to pay your first payment.

The third stage is where the remaining balance is typically paid later through deferred payments funded by the company’s ongoing profits. You can set this period of time during the second stage – when setting this, you need to make sure that the repayments to you are met while also allowing the business to continue operating.

Take our 5 minute test to see if you are ready for an Employee Ownership Trust

Take our test to see if you are ready for an exit via an EOT and then book a call to talk through the next steps.

Plan the structure and timing

Careful consideration is required for the sale's structure, including issues like retained shareholdings, minority shareholdings, and share options for senior management, along with the terms of deferred consideration. It's crucial to structure debt and deferred consideration repayments to ensure the business can meet its future working capital and investment needs post-transaction.

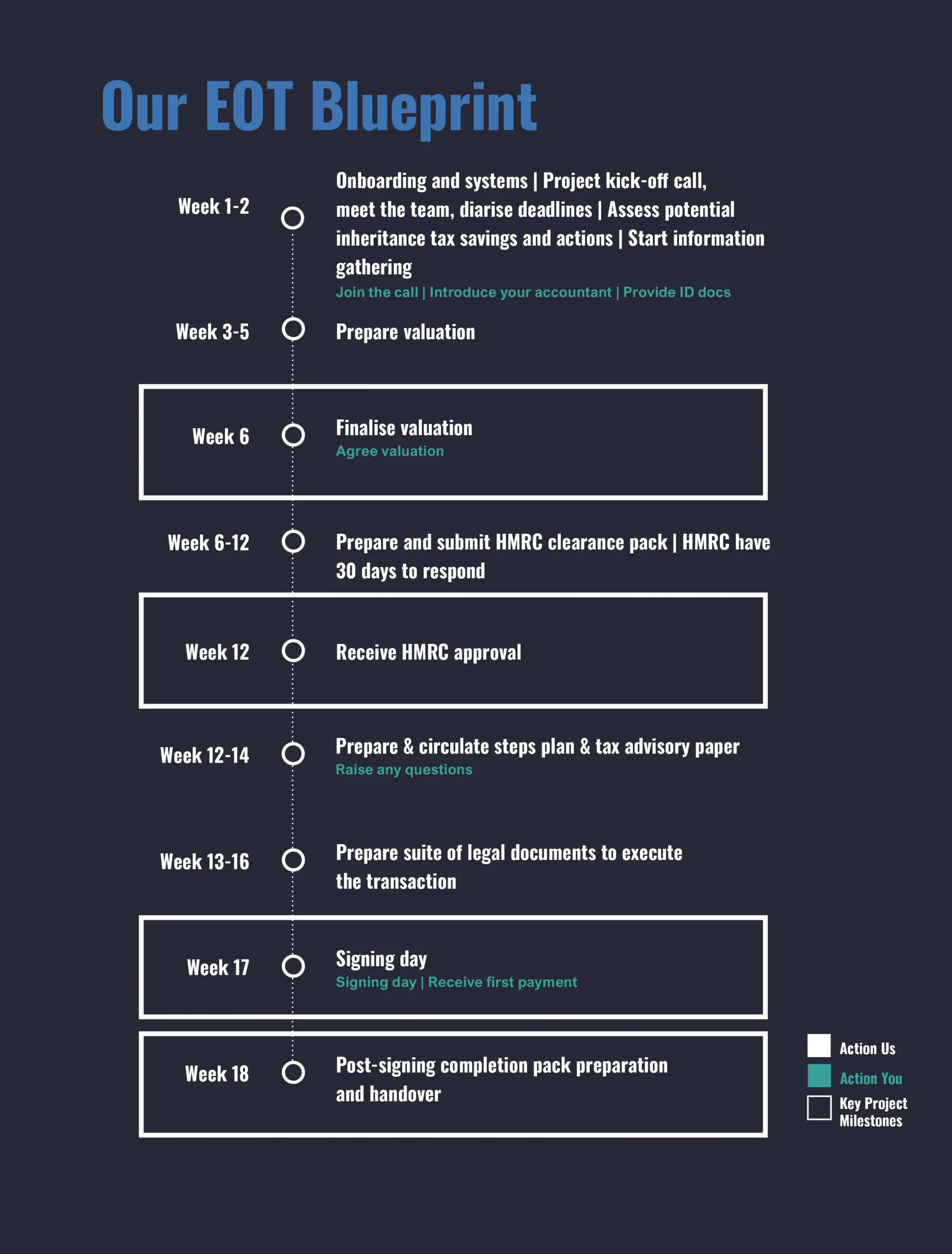

As for the timeline, the duration of the EOT sale process varies based on complexity. Assuming a straightforward process with quick decision-making, it can be completed in around 18 weeks.

This is a typical timeline highlighting key milestones and actions needed by both us and you.

Expert Support from Start to Finish

Setting up an EOT is a comprehensive project, including considerations for funding, tax arrangements, collaboration with solicitors for the trust deed, and more. We handle all of this for you.